In this article, we will review topics related to finance management in the Retail Business Manager Excel Template.

Retail Business Manager Excel Template – Product Page Support Page

VIDEO DEMO

Order Related Costs

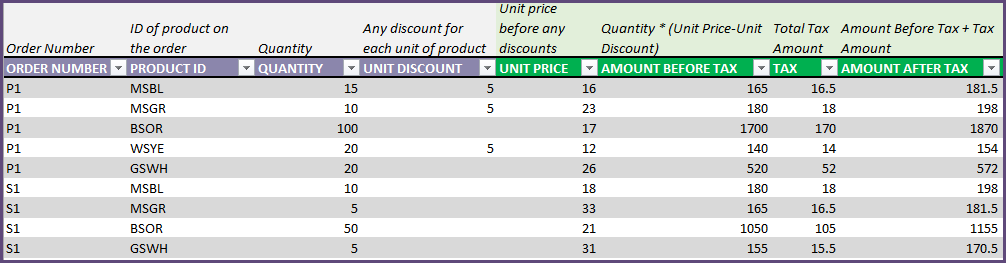

When we enter the order line items in the Order Details sheet, we are entering the purchase costs of products (in a purchase order) and sales prices of products (in a sale order). We are also entering any product level discounts.

Other Charges

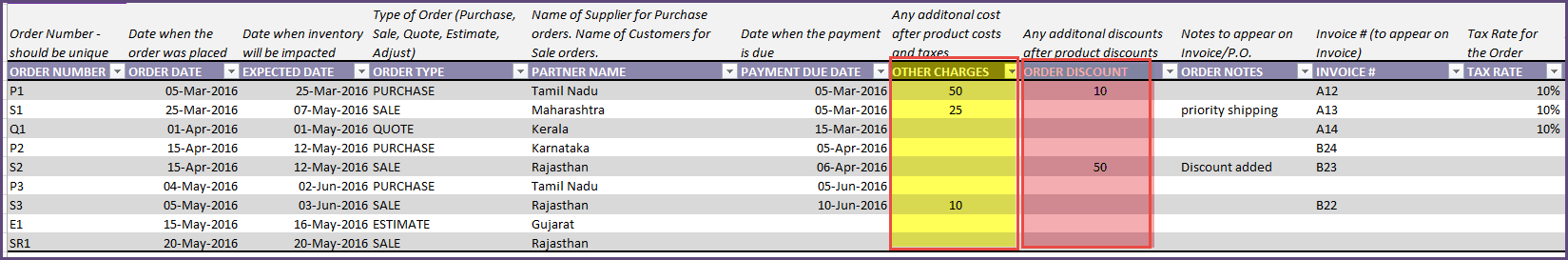

In addition to this, any order level charges can be entered in the Order Headers sheet. This will be added to the Total Order Amount. Also, any order level discounts can be entered there. This amount will be deducted to calculate the Total Order Amount.

Entering Payments made

In a sale order when the customer makes the payment, we enter the paid amount in the Order Headers sheet. Similarly, for a Purchase order when we pay the supplier, we will enter the paid amount.

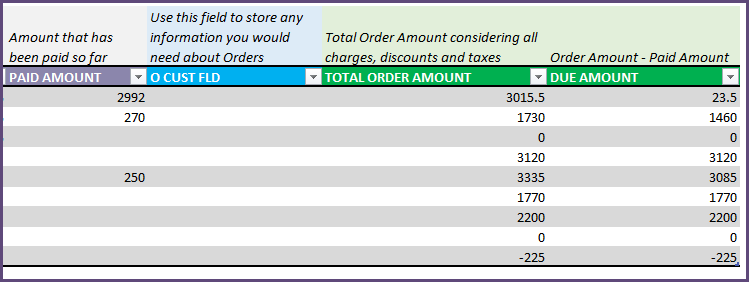

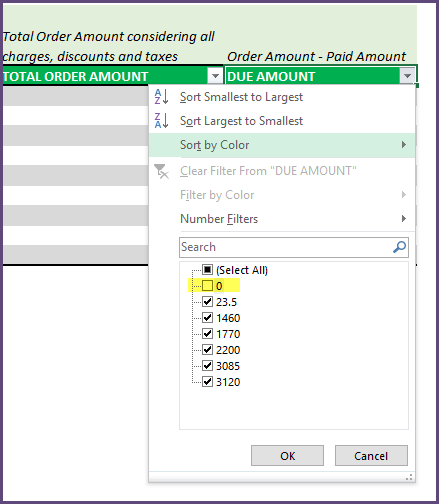

Due Amount will be calculated for each order as (Total Order Amount – Paid Amount). You can filter on this filed to limit the data to only orders which are still due (Filter to values other than 0).

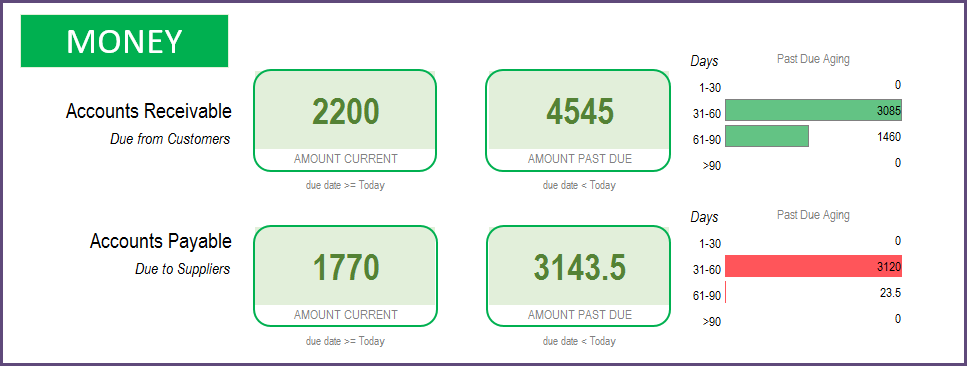

Accounts Receivable and Accounts Payable Summary

We can see the overall current status of accounts receivable and accounts payable in the Report sheet.

We can also see the aging of the payments due (1-30 days, 31-60 days, 61-90 days, >90 days).

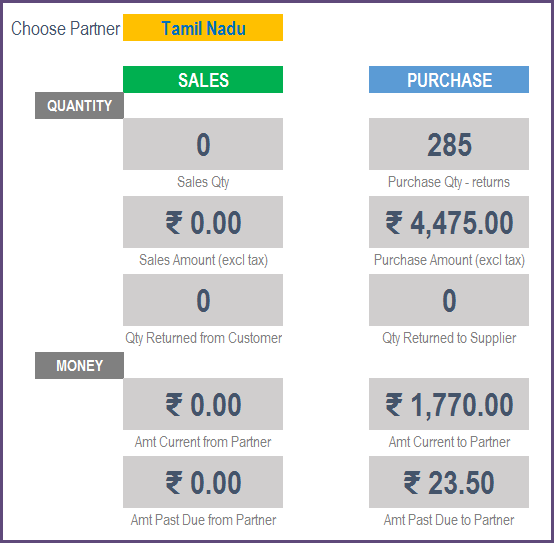

When we choose a specific partner, we can see the financial status.

Operational Expenses

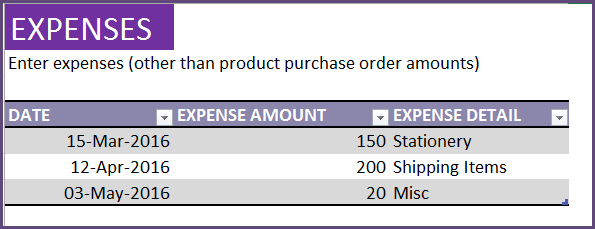

All the other operational expenses not directly related to any one specific order, should be entered in the Expenses sheet. For example, if you buy any stationery for your business or subscribe to any other business service, you can enter those expenses here.

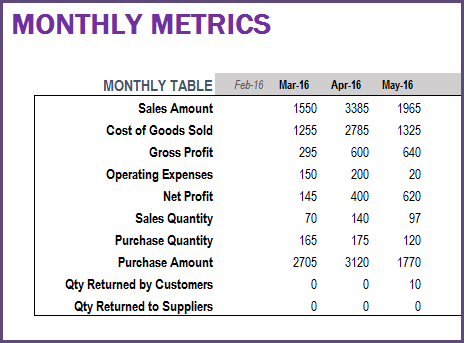

We calculate Net profit as (Gross Profit – Operational Expenses) and display that in the Report sheet.